Each year customers come to Telebooks Network and ask us how much bookkeeping really costs for small architecture and engineering (A/E) firms. This is a very good question. We can certainly understand the need to know the cost, as it serves as an important input to your decision on how to implement your firm’s financial management.

Here at Telebooks Network, we teach small A/E firms how to perform their accounting operations in-house by following simple patterns. But the truth of the matter is that in-house accounting might not be the best choice for you. In fact, outsourcing your accounting functions might be the better option. What this article is going to do is explain the estimated costs for in-house accounting vs. outsourced accounting and provide the pros and cons of each solution. Then, you’ll be able to identify which is the best solution for you.

Introduction to Bookkeeping Costs

Bookkeeping is the backbone of financial management for any A/E firm. It involves recording, classifying, and summarizing financial transactions to ensure accurate financial statements and compliance with tax regulations. For small A/E firms, managing bookkeeping effectively is essential to stay organized and focus on delivering exceptional designs.

But how much does bookkeeping actually cost? The answer isn’t straightforward because costs can vary based on several factors. In this guide, we’ll explore the key factors influencing bookkeeping costs, provide a detailed breakdown of expenses, and help you determine the best bookkeeping solution for your firm. As you read this post, remember that a good benchmark for your bookkeeping budget is 2-3% of annual revenue, with solopreneurs or very small firms possibly exceeding this by 1-2%.

Why Bookkeeping is Crucial for A/E Firms

- Transparency and Control: Proper bookkeeping provides a clear picture of your firm’s financial health, helping you make informed decisions. It ensures that all transactions are accurately recorded and categorized, giving you control over your financial data.

- Compliance and Accuracy: Keeping accurate records is essential for tax compliance and avoiding legal issues. Bookkeeping ensures that all financial statements are correct and that you’re adhering to relevant regulations.

- Financial Insights: Effective bookkeeping allows you to analyze your firm’s financial performance. By tracking income, expenses, and cash flow, you can identify trends, make strategic decisions, and plan for the future.

Factors Influencing Bookkeeping Costs

Understanding the factors that affect bookkeeping costs is essential for budgeting effectively and ensuring your firm’s financial management is both efficient and cost-effective. Here’s a transparent look at what can impact how much you’ll spend on bookkeeping:

1. Volume of Transactions

- Definition: This includes all financial activities such as invoices, payments, receipts, and bank deposits.

- Impact: More transactions mean more time and effort are needed for recording and reconciling, which can increase bookkeeping costs. High transaction volumes require more detailed management and reporting.

2. Number of Bank Accounts

- Definition: The total number of bank accounts your firm maintains, such as checking, savings, and investment accounts.

- Impact: Managing multiple accounts adds complexity to reconciliations and financial tracking. Each account needs to be reconciled separately, which can increase bookkeeping costs.

3. Number of Credit Cards

- Definition: The number of credit cards used by your firm, including corporate and employee cards.

- Impact: Each credit card generates additional transactions that need to be recorded and managed. More credit cards increase the workload and can raise bookkeeping costs due to the additional transaction management required.

4. Payroll Management

- Definition: Calculating employee wages, managing deductions, and ensuring compliance with payroll regulations.

- Impact: Payroll management involves precise calculations and regulatory compliance. The more employees you have or the more complex the payroll needs, the higher the costs for payroll processing. A typical payroll provider may charge $150 in monthly fees plus $24 per employee, per month.

5. Software and Tools

- Definition: The accounting software and tools used for managing finances, such as subscriptions for accounting and invoicing systems.

- Impact: Costs for accounting software can range from $50 to $150 per month. Additional tools or integrations with other systems may increase expenses. Some bookkeeping services include software costs in their fees, while others require separate subscriptions.

6. Training Costs

- Definition: Expenses related to training staff or yourself in bookkeeping practices and software usage.

- Impact: Training is crucial for ensuring that the person handling bookkeeping is proficient and up-to-date with the latest practices and software. Training costs can vary based on the complexity of the tasks and the depth of the training required.

7. Standard Procedures

- Definition: The established routines and practices used to manage financial transactions and records.

- Impact: Implementing standard procedures ensures consistency and accuracy in bookkeeping but may involve setup costs and ongoing maintenance. Firms that adopt standardized processes, such as regular reconciliation schedules, uniform expense reporting, and structured financial documentation, can manage their bookkeeping more efficiently. However, developing and maintaining these procedures may incur additional costs initially and require periodic updates to align with changing regulations or business needs.

Bookkeeping Costs: A Detailed Breakdown

1. In-House Bookkeeping Costs

Managing bookkeeping in-house can vary greatly depending on who handles the tasks and the associated costs. Here’s a breakdown of the costs involved with different in-house bookkeeping options:

- Owner Manages Bookkeeping – Time spent on bookkeeping is time not spent on billable work. If you spend 5-10 hours a week on bookkeeping and your billable rate is $100 per hour, this could cost you $2,000 to $4,000 per month (opportunity cost).

- Office Manager Performs Bookkeeping – The average salary for an office manager in the U.S. ranges from $40,000 to $60,000 per year. If bookkeeping tasks account for 20-30% of their time, you can estimate bookkeeping costs at around $700 to $1,500 per month.

- Part-Time Bookkeeper (Employee) – Part-time bookkeepers typically charge between $25 and $50 per hour. Monthly costs depend on the number of hours worked. For example, 20 hours per week at $35 per hour totals approximately $2,800 per month.

- Full-Time Bookkeeper – Full-time bookkeepers earn between $45,000 and $65,000 per year, plus benefits, which can add 20-30% to the base salary. This equates to a range of $4,500 to $7,000 per month.

2. Outsourced Bookkeeping Costs

Outsourcing your bookkeeping needs can be an efficient way to manage finances without the overhead of additional staff. Here’s a detailed look at the costs associated with outsourcing to freelance bookkeepers and bookkeeping firms:

- Freelance Bookkeeper (Independent Contractor) – Freelance bookkeepers charge between $40 and $100 per hour, depending on expertise and the complexity of tasks. For example, 20 hours per week at $60 per hour costs about $4,800 per month.

- Bookkeeping Firm – Bookkeeping firms offer tiered packages, with basic services costing between $500 to $2,500+ per month, depending on the factors influencing bookkeeping costs (see section above).

How to Choose the Right Bookkeeping Option for Your Firm

With a clear understanding of the costs involved, you can choose the bookkeeping option that best suits your firm’s needs. Below, we outline the pros and cons of in-house versus outsourced bookkeeping to aid your decision-making.

1. In-House Bookkeeping: Pros and Cons

Pros:

- Control and Oversight: Direct management of your financial records provides greater control and immediate oversight.

- Tailored to Your Business: An in-house bookkeeper can develop a deep understanding of your firm’s operations.

- Quick Access to Information: Immediate access to financial information allows for agile decision-making.

- Confidentiality: Greater confidence in the security of sensitive financial data.

Cons:

- Higher Costs: Hiring in-house staff can be more expensive than outsourcing, considering salaries, benefits, and training.

- Resource Intensive: Managing an in-house bookkeeping operation requires significant time and investment.

- Risk of Errors: Inexperienced staff may increase the risk of costly errors and compliance issues.

- Limited Expertise: In-house bookkeepers may have less exposure to the latest practices compared to professionals at bookkeeping firms.

2. Outsourced Bookkeeping: Pros and Cons

Pros:

- Cost-Effective: Often more affordable than hiring in-house staff, especially for smaller firms.

- Expertise and Specialization: Access to skilled professionals who stay up-to-date on the latest practices.

- Scalability: Services can scale with your business needs without the hassle of hiring or laying off staff.

- Focus on Core Business: Allows your team to concentrate on core activities like design and client relationships.

Cons:

- Less Control: Relinquishing some control over financial record management can be frustrating if the service doesn’t fully align with your needs.

- Communication Challenges: Potential challenges in communication, especially if the provider is unfamiliar with your industry or in a different time zone.

- Data Security Concerns: Sharing sensitive information with a third party may raise confidentiality concerns.

- Dependence on External Providers: Your firm’s operations could be affected by the provider’s availability and reliability.

Industry Trends and Typical Practices for Bookkeeping in Architecture Firms

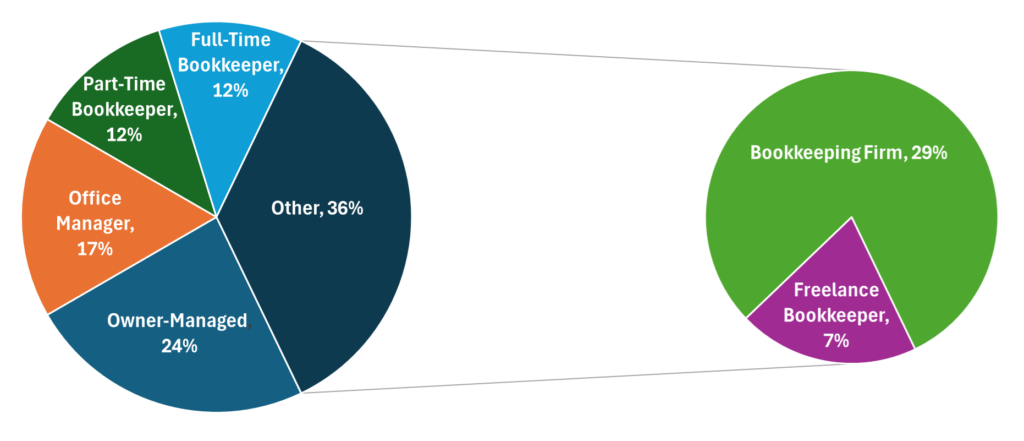

Understanding who manages bookkeeping in architecture firms can reveal valuable industry trends and practices. Here’s an overview of the typical approaches and their prevalence:

1. Owner-Managed Bookkeeping (20-30%)

In many small architecture firms, particularly those with fewer than 10 employees, the firm owner takes on the bookkeeping responsibilities. This practice is often driven by cost-saving measures and a desire to maintain direct control over financial matters. Owners typically use accounting software to handle tasks such as transaction recording, invoicing, and financial reporting. This approach is suitable for firms with manageable financial volumes, allowing owners to stay closely connected to their firm’s financial health.

2. Office Manager Performs Bookkeeping (15-20%)

As architecture firms grow, office managers often assume bookkeeping duties along with their other administrative responsibilities. This setup is common in firms where a single person manages multiple functions, including financial tasks. Office managers handling bookkeeping integrate these duties with other roles, such as client communication and office administration. This approach is practical for firms that need a dedicated individual for daily financial management without requiring a full-time bookkeeper.

3. Part-Time Bookkeeper (10-15%)

For firms with moderate financial complexity, hiring a part-time bookkeeper is a popular choice. About 10-15% of architecture firms opt for this solution to manage essential tasks like transaction recording, bank reconciliations, and financial reporting. A part-time bookkeeper offers a cost-effective balance between professional expertise and expense, providing flexibility as the firm’s financial needs evolve.

4. Full-Time Bookkeeper (10-15%)

Medium to larger architecture firms often employ a full-time bookkeeper to handle comprehensive financial duties. Approximately 10-15% of firms hire a full-time bookkeeper to manage payroll, budgeting, compliance, and other detailed financial tasks. This role is crucial for firms with high transaction volumes or complex financial needs, ensuring thorough attention to financial details and regulatory compliance.

5. Freelance Bookkeeper (5-10%)

Freelance bookkeepers are chosen by about 5-10% of architecture firms seeking flexible, specialized services. Freelancers work on an hourly or project basis, making them ideal for firms with fluctuating bookkeeping needs or those needing temporary assistance. This arrangement allows firms to access professional expertise without long-term commitments, providing scalability and cost-effectiveness.

6. Bookkeeping Firm (25-35%)

Approximately 25-35% of architecture firms engage bookkeeping firms for their financial management needs. Bookkeeping firms offer full-service packages, including regular financial management, reporting, and compliance. This option is attractive to firms that prefer to focus on their core business functions while leveraging external experts for comprehensive financial oversight. Bookkeeping firms provide specialized knowledge and scalable solutions, accommodating the firm’s growth and evolving financial requirements.

Conclusion: Empowering Your Firm with the Right Bookkeeping Solution

Understanding bookkeeping costs and choosing the right solution is crucial for the financial health of your small A/E firm. By breaking down costs transparently and evaluating the factors that influence them, you’re empowered to make informed decisions that align with your firm’s needs and budget.

Effective bookkeeping is more than just a financial necessity—it’s a strategic tool that helps you maintain control, ensure compliance, and gain valuable insights into your firm’s financial performance. Whether you opt for in-house management or outsourcing, each approach has its own set of benefits and considerations.

In-House Management: Provides you with direct control and the ability to customize processes but comes with higher costs and management responsibilities.

Outsourcing: Offers cost-effective solutions and access to specialized expertise but may involve less control and potential communication challenges.

Whether you choose an in-house bookkeeping solution or outsourced services, the goal is to ensure accurate financial management and compliance, allowing you to focus on what you do best—delivering outstanding architectural designs.

If you have questions or need guidance on selecting the right bookkeeping option for your firm, don’t hesitate to seek professional advice. By staying informed and proactive, you can manage your finances effectively and set your firm up for long-term success.

Subscribe to Learn More

Improve efficiencies at your architecture, engineering, or design firm by subscribing to this blog. Specifically, the blog provides hints and tips for the administration of Cloud Accounting, Payroll Services, and Professional Services Automation. When you subscribe, you get notifications when new posts are published. To subscribe to this blog, enter your email in the block below, and click the Subscribe button.