Introduction

Managing in-house bookkeeping for architects is a common challenge for many small architecture firms. You know how important accurate bookkeeping is for your firm’s financial health. However, without the resources to hire a full-time accountant, it can feel overwhelming.

Some firms believe that in-house bookkeeping for architects is too complicated or time-consuming. But what if I told you it’s entirely manageable with the right tools, strategies, and workflows? By the end of this post, you’ll have a clear understanding of how to effectively handle your firm’s bookkeeping in-house—no full-time accountant required.

Here’s what we’ll cover:

- Understanding the Challenges: We’ll start by exploring the common obstacles firms face when managing in-house bookkeeping.

- Leveraging Technology: Next, we’ll dive into the best tools for streamlining bookkeeping, accounts payable, payroll, and project management specific to architects.

- Building a System: We’ll discuss how to establish routines and procedures that keep your financial data accurate and up-to-date. We’ll also cover how to handle complex tasks without a full-time accountant.

- Training Your Team: We’ll look at how to empower your team to handle in-house bookkeeping tasks effectively while avoiding common pitfalls.

- Real-Life Example: Finally, we’ll share how a small firm, Elemental Architects, successfully transformed their financial operations with these strategies.

Let’s dive into practical, actionable solutions to help your architecture firm manage its finances efficiently.

1. The Challenge of Managing In-House Bookkeeping for Architects

Time is a precious commodity in any small business, and architecture firms are no exception. Balancing the demands of running projects, meeting with clients, and managing your team can leave little room for anything else—let alone bookkeeping.

And let’s face it: accounting isn’t everyone’s strong suit. The fear of making costly mistakes can make in-house bookkeeping seem like a daunting task. But does it really have to be that way?

Suppose you’re the owner or staff member at Elemental Architects. You’re facing these exact challenges—limited time, limited resources, and limited accounting knowledge. You know you need to keep your finances in order, but just keeping them up-to-date feels overwhelming. Does this sound familiar?

What specific bookkeeping challenges are holding your firm back, and how much time could you save by addressing them head-on?

2. Leveraging Technology: The Right Tools for In-House Bookkeeping

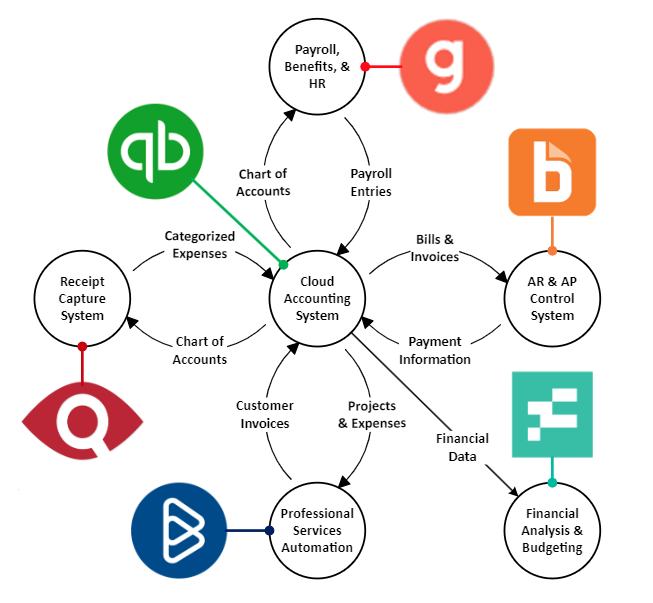

One of the most effective ways to manage in-house bookkeeping for architects is by leveraging technology. The right tools can simplify the process and reduce the need for extensive accounting expertise.

Accounting Software

Tools like QuickBooks Online, Xero, and FreshBooks are designed to make bookkeeping straightforward, even for those without a background in accounting. These platforms offer user-friendly interfaces and powerful features that allow you to manage invoices, track expenses, and generate financial reports with ease. The best part? You don’t need to be a financial whiz to use them.

AP/AR Software

Tools like Bill.com, Melio, and Tipalti simplify the management of accounts payable and receivable, streamlining tasks like invoicing, payments, and cash flow management. These platforms automate bill processing and payment collection, enabling you to approve payments, send invoices, and track transactions with ease. By integrating with your accounting software, they keep financial data accurate and up-to-date, minimizing errors and improving overall efficiency.

Payroll Integration

Handling payroll can be tricky, but integrating it with your accounting software can save you time and prevent errors. Solutions like Gusto, ADP, or Paychex integrate seamlessly with your accounting system. They automate payroll calculations, tax filings, and direct deposits, ensuring accuracy and reducing the burden on your team. These tools also provide benefits integration, making it easier to manage health insurance, retirement plans, and more.

Project Management Integration

As an architecture firm, tracking project expenses and billable hours is crucial. Tools like BigTime, Monograph, or BQE Core integrate project management with your accounting software, providing a seamless way to manage both. This integration helps you keep everything in one place, making it easier to monitor project budgets and profitability.

Which of these tools could immediately simplify your bookkeeping processes and reduce the time you spend on financial management?

3. Building a System for In-House Bookkeeping

Even with the right tools, in-house bookkeeping for architects requires a well-organized system to ensure consistency and accuracy. This system must also handle more complex bookkeeping tasks without a full-time accountant. Here’s how to build one that works.

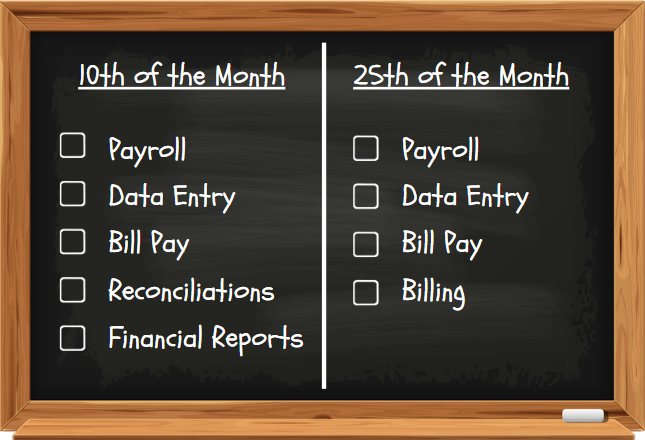

Developing a Routine

First, establish a regular bookkeeping routine that fits into your firm’s workflow. Whether it’s dedicating time each week to review expenses and reconcile accounts or setting up daily reminders to log transactions, consistency is key. A routine helps ensure that bookkeeping tasks don’t pile up, becoming a mountain of work.

Standard Operating Procedures (SOPs)

Next, create SOPs for key bookkeeping tasks to ensure consistency and accuracy across your team. These can include:

- Data Entry: Outline the process for entering financial data, such as expenses, revenue, and other transactions, into your accounting software. This should include steps for categorizing transactions accurately and using tools like AutoEntry to automate and streamline data entry.

- Payroll: Establish a clear procedure for managing payroll, from collecting and verifying time entries to processing payments through your payroll software. Ensure this integrates with your accounting system to maintain up-to-date financial records and ensure tax compliance.

- Bill Pay: Define the steps for managing accounts payable, including receiving, approving, and paying invoices. Use AP software like Bill.com to automate these processes and ensure timely payments while keeping cash flow under control.

- Account Reconciliation: Set up guidelines for regularly reconciling your bank accounts, credit card statements, and other financial accounts. This process should verify that all transactions are recorded accurately and help identify any discrepancies early.

- Financial Reporting: Develop procedures for generating regular financial reports, such as profit and loss statements, balance sheets, and cash flow statements. Use these reports to monitor your firm’s financial health and make informed business decisions.

- Billing: Use a project management software, like BigTime, and establish a standardized process for creating, sending, and following up on client invoices. This should include verifying billable hours, applying project-related expenses, and ensuring that invoices align with the agreed-upon fee schedule.

How well does your current system address both routine and complex bookkeeping tasks, and where might there be room for improvement?

4. Training Your Team to Handle Bookkeeping Tasks

Even with the best tools and a solid system, your team needs to be equipped to handle bookkeeping tasks effectively.

Basic Training

Start with the basics. Provide training on how to use your chosen accounting software. Emphasize the importance of accuracy and consistency. Most platforms offer tutorials, webinars, and customer support to help your team get up to speed quickly.

Empower Your Team

Next, empower your team members by encouraging them to take ownership of their role in the in-house bookkeeping process. When your team understands how their contributions impact the firm’s success, they’re more likely to approach their tasks with care and attention.

Ongoing Skill Development

Set aside time for ongoing skill development. Whether it’s through online courses or in-house workshops, continued learning ensures that your team stays updated on best practices and software updates. This is crucial for maintaining accuracy and efficiency in your bookkeeping process.

Clear Communication

Lastly, keep the lines of communication open. Make sure your team knows that they can come to you with questions or concerns about the bookkeeping process. Clear, ongoing communication helps prevent small issues from becoming big problems.

How confident is your team in handling their bookkeeping responsibilities, and what additional training might help them excel?

5. Real-Life Example of Tools in Action

Let’s revisit Elemental Architects, a small firm struggling to balance design work with financial management. While Elemental Architects is fictional, the tools and strategies are real and practical for firms like yours.

Elemental Architects knew something had to change, so they started with QuickBooks Online, which became the backbone of their in-house bookkeeping. This platform not only streamlined expense tracking and financial reporting, but it also allowed them to easily add new applications like AutoEntry for data entry and Fathom for financial analysis, enhancing their capabilities without adding complexity.

To manage accounts payable and receivable, they integrated Bill.com, making invoicing and payment processing nearly effortless. For payroll, they chose Gusto, whose intuitive platform handled payroll calculations, tax filings, and employee benefits seamlessly, backed by exceptional support.

For project management, BigTime became their go-to tool, helping them track time, expenses, and generate accurate invoices. With everything connected to QuickBooks Online, Elemental Architects achieved consistent, reliable financial data. This transformed their operations and allowed them to focus on what they do best: creating exceptional architecture.

Conclusion

In-house bookkeeping for architects doesn’t have to be overwhelming. By leveraging the right tools, establishing solid routines, and providing proper training, your firm can manage its finances efficiently without the need for a full-time accountant. This approach gives you greater control and accuracy, allowing you to make informed decisions that support your firm’s growth.

As your firm implements these strategies, you’ll find that financial management becomes less of a burden and more of a strength. Regular reviews and a well-trained team will keep your bookkeeping accurate and up-to-date, giving you the confidence to focus on delivering outstanding architectural projects.

Taking the time to build a strong financial foundation today will pay off in the long run, positioning your firm for sustainable success. With these strategies in place, your firm will be better equipped to navigate challenges, seize opportunities, and achieve its full potential.

Ready to Take Control of Your Firm’s Financial Operations?

At Telebooks Network, we specialize in helping small architecture firms like yours achieve in-house financial mastery. Whether you’re looking to streamline bookkeeping, payroll, or billing, we provide the expert-led courses, ready-to-implement standard operating procedures, and monthly group coaching sessions you need to take full control of your firm’s finances.

Join Telebooks Network today and gain immediate access to our comprehensive resources, including ready-to-implement SOPs tailored for your firm’s needs. Take advantage of our monthly group coaching sessions to stay on track and continuously improve your financial management processes.

Let’s get started together.

Visit Telebooks Network to learn more about how we can help your firm thrive by mastering in-house bookkeeping, payroll, and billing. Connect with us today, and take the first step toward a more efficient and financially healthy architecture firm.

Subscribe to Learn More

Improve efficiencies at your architecture, engineering, or design firm by subscribing to this blog. Specifically, the blog provides hints and tips for the administration of Cloud Accounting, Payroll Services, and Professional Services Automation. When you subscribe, you get notifications when new posts are published. To subscribe to this blog, enter your email in the block below, and click the Subscribe button.