Why is account reconciliation so important? In accounting, there will be errors. Reconciling your accounts is one of the best ways to catch errors and to fix them.

Account Reconciliation Frequency

Usually, the sooner you catch an error, the easier it is to fix. Therefore, it is important to perform your bookkeeping activities on a regular basis, where the frequency depends upon the activity. For example, you may perform records management, accounts receivable, and accounts payable activities on a weekly basis. And you may perform account reconciliation and financial reporting on a monthly basis. By adhering to a regular schedule, you will catch issues early, and you will be able to resolve them quickly.

Account Reconciliation Requirements

Your accounting software should provide a means to reconcile accounts. This process requires certain inputs. First, you need the month-end balance for the account, which is usually available from the monthly statement. Next, you need the individual transactions, which usually synchronize with QuickBooks via a bank or credit card connection or feed. The reconcile function of the accounting software helps to select the individual transactions for the month that add up to the month-end balance. If there is a difference, then you must find the imbalance.

Asset and Liability Accounts

You reconcile asset and liability accounts, including bank accounts, credit cards, and loan accounts. Your accounting software should provide a means to reconcile asset and liability accounts. What do you need to reconcile? You need an ending balance and ending date from corresponding monthly statements. If your reconcile your account and transactions, then each transaction is present in your accounting software, and the sum-total of these transactions equals the month-end balance in the monthly statement.

Accounts Receivable, Accounts Payable, Undeposited Funds, and Clearing Accounts

In addition to reconciling bank, credit card, and loan accounts, it is important to reconcile your accounts receivable, accounts payable, undeposited funds, and clearing accounts. For these accounts, there is not a monthly statement, so you must reconcile with your balance sheet or account register. When balancing accounts receivable and accounts payable, you reconcile with the corresponding line items in your balance sheet. And when you reconcile undeposited funds or a clearing account, you reconcile with the ending balance of the corresponding account register in QuickBooks. For a clearing account or an undeposited funds account, the ending balance should be zero (i.e., clear). You should leverage the reporting functions of your accounting sofware to reconcile your accounts receivable, accounts payable, undeposited funds, and clearing accounts. You may use the reporting functions to generate a balance sheet or a transaction report for an account register.

Reverse Old, Uncleared Transactions

The reconciliation process excludes transactions that do not clear from your bank or credit card account during the period. If the transactions are valid, they may clear during the next period. Otherwise, when transactions do not clear, they become old. If you find an old, unreconciled transaction that is no longer valid, then it is important to reverse the transaction in the current period. This action clears the transaction from your books. Please note that old, uncleared transactions should not be deleted, so as to not impact results for previous financial periods, which may have been reported to management, investors, or the Internal Revenue Service.

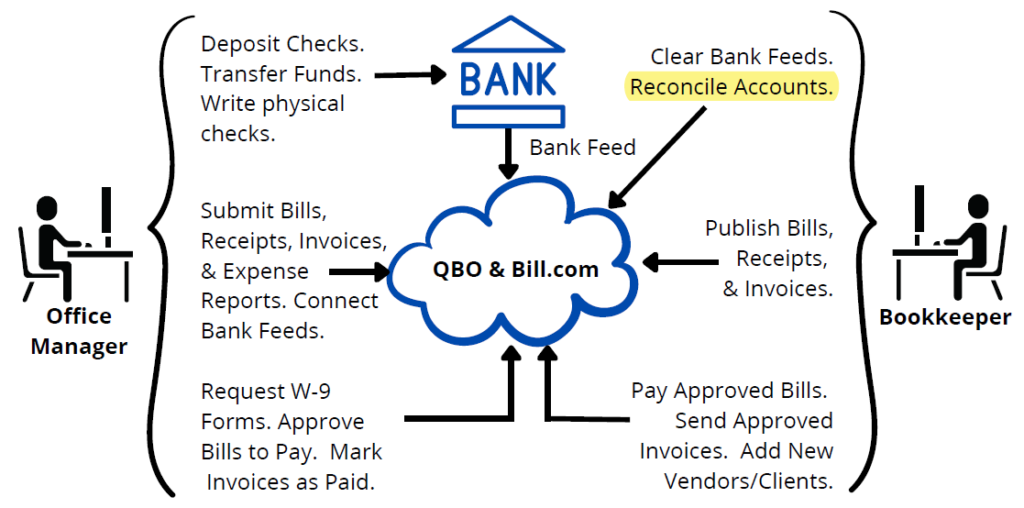

Account Reconciliation Roles & Responsibilities

In the context of the Client/Bookkeeper relationship, account reconciliation is the responsibility of the Bookkeeper. This is communicated in the following overview diagram for cloud-based bookkeeping roles & responsibilities. Depending upon your staffing strategy, the office manager and bookkeeper roles may be delegated to one or more employees. Alternatively, you may decide to outsource the bookkeeper role.

Account Reconciliation Concept of Operations

Now consider a concept of operations for account reconciliation using QuickBooks Online. Once a week, your bookkeeper publishes financial documents (bills, receipts, & invoices) to QuickBooks from the records management system. When the end of the month arrives, your bookkeeper downloads a monthly statement for the bank, credit card, and loan accounts. When using the ‘Reconcile’ function of QuickBooks, your bookkeeper enters the end of the month balance and date for each account, and QuickBooks selects transactions that have cleared in the account registers and that add up to the month-end balance.

In Case of an Imbalance

In case of an imbalance, your bookkeeper compares each transaction on the monthly statement with each transaction in QuickBooks, in chronological order, until the discrepancy is identified. Common discrepancies include duplicate transactions or missing transactions. When found, your bookkeeper should remove duplicate transactions and add missing transactions, in order to fix the imbalance. Once you have fixed the imbalance, and all bank, credit card, and loan accounts are reconciled, then your bookkeeper proceeds to reconcile your accounts receivable and accounts payable.

Leverage QuickBooks Reports & Account Registers

Your bookkeeper may determine the month-end balance for accounts receivable and accounts payable by running an A/R Aging Detail report and an A/P Aging Detail report, respectively, in QuickBooks. Then your bookkeeper compares the month-end balance for each with the corresponding line item in the balance sheet as of the last day of the month. Finally, your bookkeeper reconciles your undeposited funds and clearing accounts by confirming the month-end balance for each account register in QuickBooks is zero. Depending on the types of asset and liability accounts that you have, your bookkeeper may have other accounts to reconcile, e.g., petty cash, or an inter-company loan.

In Case of Old, Uncleared Transactions

Finally, your bookkeeper uses the reporting function of QuickBooks to run a ‘Transaction Detail by Account’ report, to check for old, uncleared transactions. Your bookkeeper selects last month for the report period. To search for old, uncleared bank transactions, your bookkeeper selects the ‘Distribution Account’ and ‘Cleared’ filters and selects the ‘All Bank Accounts’ and ‘Uncleared’ options from the corresponding dropdown menus. To search for old, uncleared credit card transactions, your bookkeeper selects the ‘All Credit Card Accounts’ dropdown option, instead of the ‘All Bank Accounts’ dropdown option. When old, uncleared transactions exist in your accounts, then your office manager should follow up with vendors and/or customers to check the status. If a transaction is no longer valid, then your bookkeeper reverses the transaction in the current month, in order to maintain the integrity of previous financial reporting periods.

Account Reconciliation Workflow

Account Reconciliation is performed at the end of each month. You may choose to manage the workflow by entering it into a cloud-based workflow application. The one I use is 17hats.

| Step | Description |

| 1 | Clear QBO bank feeds for the period – For transactions in the bank feeds that do not match to a deposit, expense, journal entry, or bill payment, post the missing documentation to QBO (and match). |

| 2 | Update transactions allocated to Uncategorized – If you have one or more accounts for uncategorized transactions, update them in the current period to categorize them appropriately. |

| 3 | Confirm Undeposited Funds are Current – Confirm that Undeposited Funds are current at month end. |

| 4 | Confirm Account Receivable are Valid – Confirm accounts receivable are collectible. |

| 5 | Confirm Access to Bank, Credit Card, and Loan Documents – Download and save statements that are needed to reconcile. |

| 6 | Reconcile Bank Accounts, Accounts Receivable, Clearing Accounts, and Other Assets – Use the QBO reconcile function to reconcile each account to a statement balance, the balance sheet, or a zero balance, accordingly. |

| 7 | Reconcile Credit Card Accounts, Accounts Payable, Loan Accounts, and Other Current Liabilities – Use the QBO reconcile function to reconcile each account to a statement balance, the balance sheet, or a zero balance, accordingly. |

| 8 | Schedule Financial Reporting Workflow – When the Account Reconciliation Workflow is complete, schedule the Report Workflow. |

Referenced Applications

To learn more about the applications referenced in this post, please click the following external links:

- Accounting Software, QuickBooks Online (QBO): https://quickbooks.intuit.com/

- All-in-One Small Business Management Platform, 17hats: https://www.17hats.com

Subscribe to Learn More

Improve efficiencies at your architecture, engineering, or design firm by subscribing to this blog. Specifically, the blog provides hints and tips for the administration of Cloud Accounting, Payroll Services, and Professional Services Automation. When you subscribe, you get notifications when new posts are published. To subscribe to this blog, enter your email in the block below, and click the Subscribe button.