When you perform a service for a client, and the client does not pay at the time of service or in advance, then you have an account receivable. An account receivable is an asset. It is important to manage accounts receivable, in order to get paid within an agreed time frame, to manage cash flow, and to keep an accurate balance sheet.

Accounts Receivable Requirements

The best way to keep up with your accounts receivable is to have a system. Your accounts receivable system should integrate with your accounting software. The system should keep records of when customer invoices are due and whether or not they are paid, in part or in full. In addition, the system should provide a means to receive ACH payments and/or credit card payments. When applicable, the system should be capable of applying credits to a customer invoice. In addition, the system should be capable of managing customer contact information and sending customer invoices. And finally, the accounts receivable system should support invoicing with additional attachments, to meet detailed invoicing requirements, which are common in architectural billing.

Accounts Receivable Application

Although best known as an accounts payable system, Bill.com is also capable of managing your accounts receivable. If you are already using Bill.com for accounts payable, then you already have an accounts receivable solution. A benefit of using Bill.com. for accounts receivable is the ability to receive ACH payments, without paying a percentage-based fee on funds received (e.g., a 1% fee is typical). Rather, you pay a fixed fee for the monthly Bill.com service.

Accounts Receivable Roles & Responsibilities

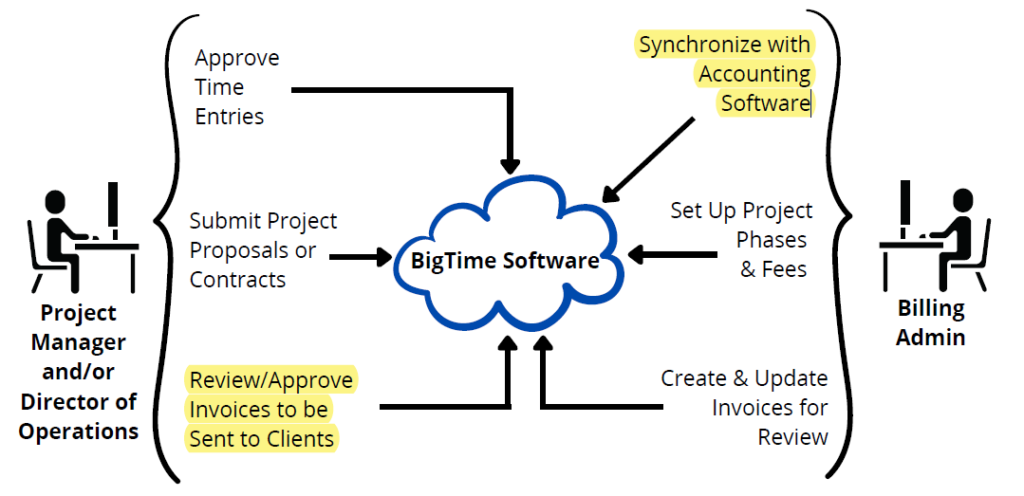

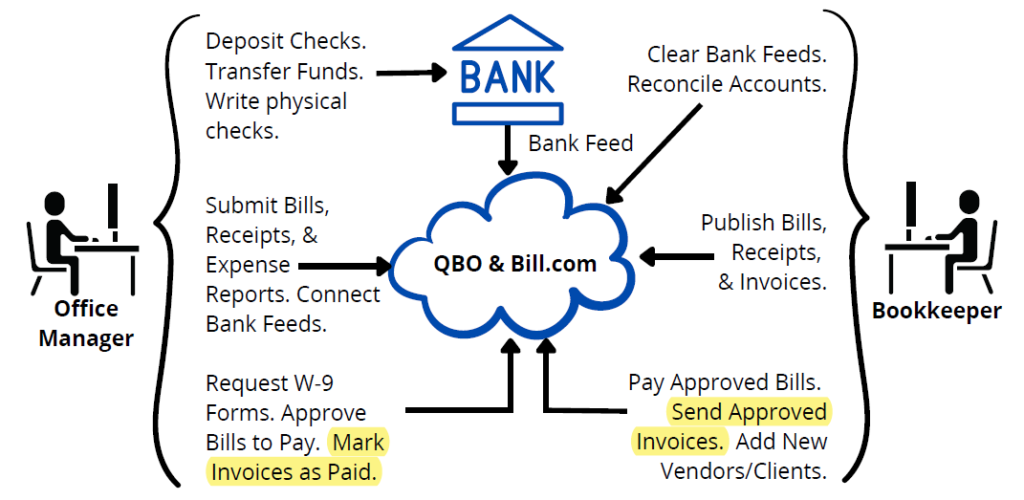

Accounts Receivable is a shared responsibility between the office manager and bookkeeper, as communicated in the following overview diagrams for cloud-based billing & bookkeeping roles & responsibilities. Depending upon your staffing strategy, the project manager, billing administrator, office manager, and bookkeeper roles may be delegated to one or more employees. Alternatively, you may decide to outsource the billing administrator and/or bookkeeper roles.

Accounts Receivable Concept of Operations

Consider a concept of operations for accounts receivable management using BigTime Software, QuickBooks Online, and Bill.com. The user roles for this concept of operations are a project manager, billing administrator, office manager, and bookkeeper. Your project manager approves a customer invoice. Then, your billing administrator publishes the customer invoice to QBO, using your professional services automation software, BigTime. Next, your bookkeeper logs in to Bill.com and performs a synchronization with your QuickBooks Online account. QuickBooks Online posts the invoice to your Bill.com account through the synchronization process.

When it is time to send invoices, usually at the end of the month, your bookkeeper opens the invoice in your Bill.com account. The bookkeeper attaches a detailed invoice (prepared by the billing administrator), with information including the percentage of completion for each phase of the project, the amount previously billed, and the amount due for this invoice. Next, the bookkeeper sends the customer invoice by email to your client, who has the option to pay online by ACH transfer, using a link provided in the email. When the client pays the invoice by check, your office manager opens the invoice in Bill.com. When the invoice is open, the office manager marks the invoice as paid. During a daily synchronization process, Bill.com communicates the paid status to QuickBooks Online.

Accounts Receivable Workflow

The ‘Get Paid’ workflow depends upon regular submission of customer invoices, using your professional services automation software. The billing administrator performs this workflow at least once per month, with assistance from your office manager. You may choose to manage your workflows, including this one (provided below), using a cloud-based application. The one I use is 17hats.

Get Paid

| Step | Description |

| 1 | Post Approved Invoice to QBO – Create and post invoices to QBO, using your professional services automation software, BigTime. In addition to billing and invoicing, you can track time, manage resources, and gain insights into project accounting. |

| 2 | Attach Approved Invoice in QBO – Download your approved invoice from BigTime, and attach it in QBO. It would be nice if this step was performed by the BigTime/QBO integration, but for now, we do it manually. |

| 3 | Synchronize Bill.com with QBO – When you synchronize Bill.com with QBO, the approved invoice is transferred to Bill.com. |

| 4 | Attach Approved Invoice in Bill.com – Attach the approved, detailed invoice in Bill.com. Again, it would be nice if this step was performed by the QBO/BigTime integration, but for now, we do it manually. |

| 5 | Send Approved Invoice from Bill.com – When the customer receives the invoice from Bill.com, the customer has an option to pay electronically by ACH transfer, or to send a check by mail. |

| 6 | Mark the Approved Invoice as Paid in Bill.com – When the customer pays by check, the office manager marks the invoice as paid in Bill.com. (When the customer pays through Bill.com by ACH transfer, then the invoice is automatically marked as paid.) |

| 7 | Enter the Customer Deposit in QBO – When the office manager marks the invoice as paid, the funds are marked as undeposited. The bookkeeper enters a corresponding customer deposit in QBO and matches the deposit to the corresponding payment. |

Best-of-Breed Approach

If you are familiar with the professional services automation software, then you may ask why the invoice is not sent from BigTime directly to the customer. In fact, given the technology stack described here, you have 3 options for sending invoices: (1) from QBO, (2) from BigTime, or (3) from Bill.com. Why do you choose Bill.com? You choose Bill.com when following a best-of-breed approach for selecting applications. Using the best-of-breed approach, you choose Bill.com because given the 3 choices, Bill.com is a best-of-breed application for accounts receivable (and accounts payable). In other words, we use each application in our technology stack for what it is best at managing.

Referenced Applications

To learn more about the applications referenced in this post, please click the following external links:

- Accounting Software, QuickBooks Online (QBO): https://quickbooks.intuit.com/

- Accounts Payable Application, BILL: https://www.bill.com

- Professional Services Automation Software, BigTime: https://www.bigtime.net

- All-in-One Small Business Management Platform, 17hats: https://www.17hats.com

Subscribe to Learn More

Improve efficiencies at your architecture, engineering, or design firm by subscribing to this blog. Specifically, the blog provides hints and tips for the administration of Cloud Accounting, Payroll Services, and Professional Services Automation. When you subscribe, you get notifications when new posts are published. To subscribe to this blog, enter your email in the block below, and click the Subscribe button.